Fashion retailers face growing pressure from rising costs, shorter product life cycles, and increasingly demanding customers who expect the right product, in the right size, at the right store, at the right time.

Fashion assortment planning becomes a strategic discipline rather than a buying task. Retailers that treat assortment planning as a structured, data-driven process gain a clear advantage: higher margins, lower markdowns, and assortments that actually reflect customer demand.

This article explains what fashion assortment planning really means, which models work best in practice, and how category managers can build an assortment plan that is both profitable and scalable.

What Is Assortment Planning in Fashion?

Assortment planning in fashion is the process of defining which products to sell, in what quantity, and in which stores to achieve specific business goals such as revenue growth, margin improvement, and stock efficiency.

In practical terms, an assortment plan translates strategy into numbers:

how many styles, how many SKUs, how much budget, and what share of space each category, subcategory, and product type should receive.

Why Is Assortment Planning Important?

Assortment planning is necessary to maintain a balance between customer desires and the business's need to make money. Retail assortment planning ensures that each store carries the right mix of styles, sizes, and colors that resonate with its specific customer base, increasing full-price sales and reducing reliance on markdowns. It aligns inventory with demand, avoiding both costly overstock situations that tie up cash and stockouts that frustrate shoppers and lead to lost revenue.

Research and industry benchmarks suggest that smarter assortment decisions -including cross-merchandising and data-driven clustering -can boost sales by up to 2–7% and improve gross margins by reducing excess inventory and markdowns by 5–10% for a typical retailer investing in advanced planning tools and analytics.

Compared with other retail sectors such as children’s products or consumer electronics, fashion is uniquely volatile: trends change rapidly, product lifecycles are short, and size/color variations multiply complexity. A toy line or gadget category may sell reliably year after year with predictable demand curves, but fashion assortments must be refreshed seasonally and tailored at the store level to reflect local preferences and trend shifts. Without disciplined planning, fashion retailers risk accumulating slow-moving inventory, breathing space problems on shelves, and damaging profitability through markdowns and excess stock -outcomes far less severe in categories with longer product lifecycles and narrower variation sets.

Why Fashion Assortment Planning Fails in Many Offline Retailers

Underlying many assortment planning failures are several recurring operational and organizational issues:

- Limited visibility at SKU level.

Many retailers lack a clear view of which specific styles, sizes, and colors generate profit versus simply generate sales. Without SKU-level profitability and sell-through data, planners cannot make informed decisions about what to expand or discontinue. - Disconnected planning and execution.

Assortment plans are often created in spreadsheets and remain isolated from replenishment, purchasing, and store operations. As a result, even a well-designed plan does not translate into consistent in-store availability. - Uniform assortments across diverse stores.

Applying the same assortment to all locations ignores differences in customer demographics, climate, store size, and purchasing behavior. This leads to overstock in some stores and missed sales opportunities in others. - Overreliance on historical sales alone.

Past performance is frequently used as the primary planning input, without adjusting for trend shifts, seasonality changes, or evolving customer preferences. - Lack of clear product roles.

Products are added to the assortment without defining whether they are intended to drive traffic, deliver margin, support trends, or complete the core offer. This creates bloated assortments with overlapping purposes.

Together, these issues prevent offline fashion retailers from building assortments that are both commercially strong and operationally efficient, resulting in higher markdowns, slower stock turnover, and lost revenue potential.

Key Data You Need Before Building an Assortment Plan

Effective fashion assortment planning starts with reliable data. Without a clear performance baseline, even the best planning frameworks become guesswork. The goal is not to collect every possible metric, but to focus on a set of indicators that directly explain demand, profitability, and inventory efficiency.

Below is a practical checklist of the core data categories required before building or revising an assortment plan.

Sales History by SKU, Category, and Store

Sales data should be available at the most granular level possible — SKU, size, color, and store. This allows category managers to identify true bestsellers, slow movers, and patterns that are invisible at aggregated category level.

Key questions this data should answer:

- Which SKUs consistently sell at full price?

- Which products sell only with markdowns?

- How does the same product perform across different stores?

This foundation enables store-level and cluster-level planning rather than a single, uniform assortment.

Gross Margin and Contribution Margin

Revenue alone does not indicate success. A product that sells well but delivers low margin may weaken overall profitability.

Margin data helps to:

- Identify high-margin “profit drivers”

- Separate volume products from margin products

- Understand the real financial impact of each category and SKU

Contribution margin adds another layer by showing how much each product contributes after variable costs, supporting more accurate investment decisions.

Sell-Through Rate

Sell-through shows what percentage of received inventory was sold within a defined period. It reflects how well demand matches supply.

Typical uses:

- Detecting overbought styles early

- Comparing performance across seasons or stores

- Setting future buy quantities

High sell-through combined with strong margin is a strong signal to scale a product or product type.

Stock Turnover

Stock turnover indicates how many times inventory is sold and replaced over a period.

This metric helps:

- Evaluate capital efficiency

- Identify categories that tie up cash

- Balance fast fashion items versus core basics

A healthy assortment contains a mix of fast-rotating items and stable core products.

Models & Frameworks for Fashion Assortment Planning

Once the data foundation is in place, models help translate numbers into structured decisions. Below are four practical frameworks widely used in successful fashion assortment planning.

a) Category Role Model

The Category Role Model defines why a category or product exists in the assortment.

Common roles in fashion:

- Core – Essential products customers expect to find (e.g., basic T-shirts, jeans)

- Traffic Driver – Items that attract customers into the store (often promotional or trend-led)

- Margin Builder – Products with strong profitability

- Seasonal – Limited-time collections tied to seasonality

- Image – Trend or statement items that shape brand perception

Each role carries different expectations for volume, margin, and risk level.

This model prevents assortments from being overloaded with products serving the same purpose.

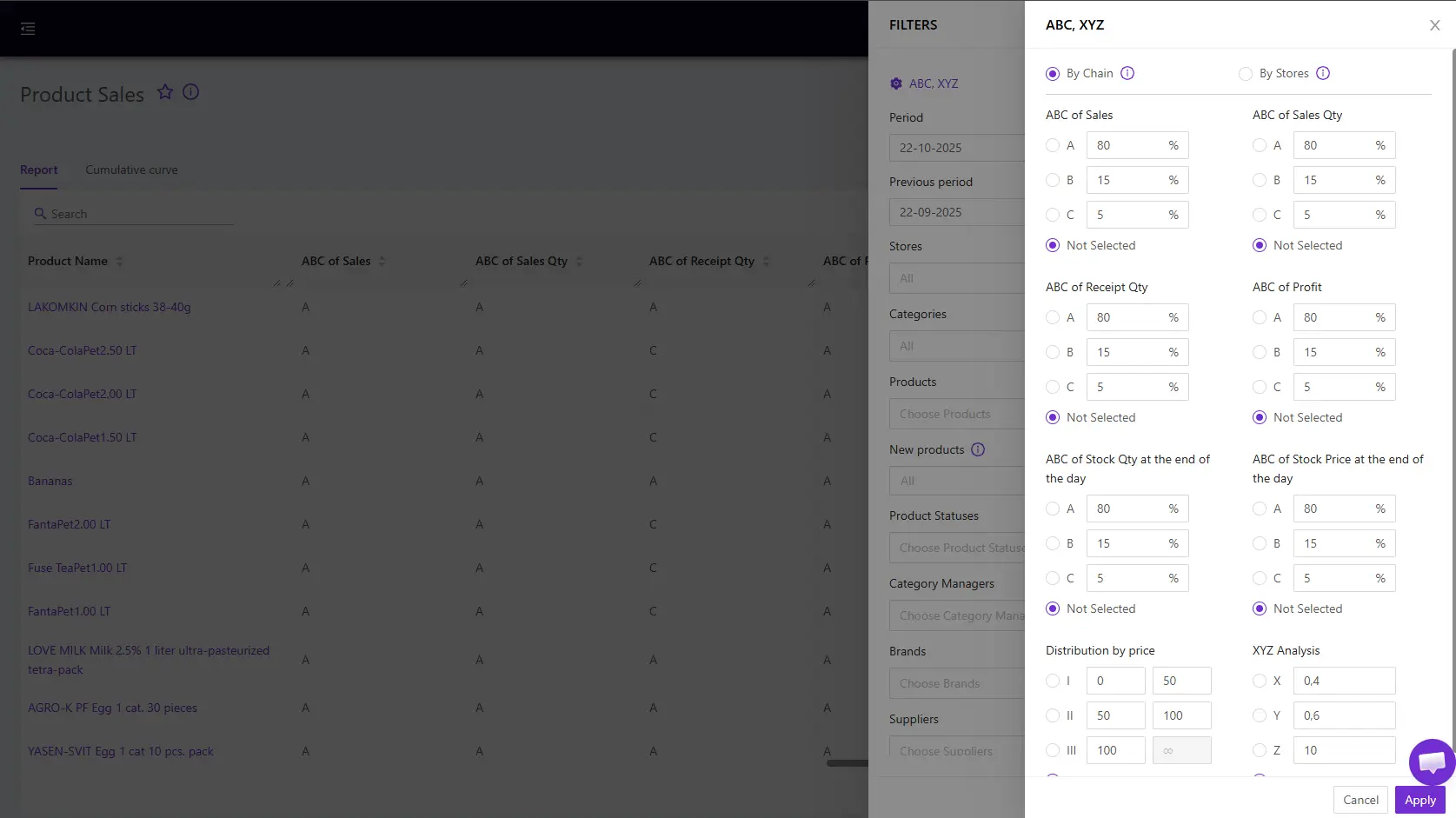

b) ABC–XYZ or ABC–GM Analysis

This model classifies products based on two dimensions:

ABC (Value or Margin Contribution):

- A: High impact

- B: Medium impact

- C: Low impact

XYZ (Demand Stability):

- X: Stable demand

- Y: Medium variability

- Z: Highly volatile

Combining both dimensions highlights:

- High-margin, stable winners

- High-risk fashion items

- Low-impact SKUs suitable for reduction

This supports rational SKU reduction and smarter investment.

Try setting up ABC/XYZ analysis in Datawiz reports.

c) Width vs Depth Matrix

This framework balances:

- Width – Number of styles

- Depth – Quantity per style

Too much width leads to complexity and weak depth.

Too much depth increases stock risk.

The matrix helps determine:

- Which categories need more choice

- Which categories need fewer styles with deeper stock

- Where to test new items with limited depth

It directly links creative assortment decisions with financial control.

d) Store Cluster Model

Stores are grouped into clusters based on similar characteristics:

- Store size

- Location type (mall, high street, neighborhood)

- Customer profile

- Historical performance

Each cluster receives a tailored assortment structure rather than a universal plan.

Benefits:

- Better local relevance

- Higher sell-through

- Lower transfer and markdown costs

For offline fashion retailers, this model is one of the strongest levers for improving performance.

Best Programs for Planning a Fashion Assortment

When investing in software for fashion assortment planning, it’s important to prioritize flexibility, automation, and intelligent assistance. The best tools not only reduce manual workload but also help your team make faster, more accurate decisions -especially when they include AI-driven insights that highlight trends, predict demand, and optimize your assortments with minimal guesswork.

Datawiz -Flexible Dashboards + AI Assistance

For offline fashion retail, Datawiz stands out as a practical analytics and planning platform built around real business needs. Its strengths lie in:

- Automatic Reports -preconfigured dashboards that update with live sales, sell-through, margin, and inventory performance.

- Interactive Dashboards -flexible views where planners can slice data by store, SKU, category, or season to spot patterns fast.

- Formula Builder - a customizable calculation engine that lets teams define and automate KPIs tailored to their assortment strategies.

- AI Wizora Assistant -built-in AI that analyzes data trends, highlights anomalies, and suggests actionable insights (e.g., underperforming SKUs, opportunities to rebalance width vs. depth).

This mix of automated reporting, customizable analytics, and AI-enhanced insights helps teams move beyond spreadsheets and toward data-driven assortment decisions that align with business goals.

Toolio -AI-Driven Assortment & Merchandise Planning

Toolio is known for combining AI insights with collaborative planning workflows. It enables teams to create, visualize, and optimize seasonal assortments with features like cluster-based planning, breadth and depth rationalization, and visual line sheets to support buying decisions. Toolio helps planners align assortment decisions with merchandise financial plans and purchase order execution -reducing reliance on spreadsheets and supporting detailed store- or cluster-level assortments.

o9 Solutions -Enterprise AI Planning

o9 offers a unified planning platform that uses predictive analytics and machine learning to improve assortment planning as part of broader merchandise and supply chain planning processes. It supports scenario modeling, localized assortments, and integration across planning functions - a good fit for larger fashion retailers with complex SKU portfolios.

What's new?

What's new?

No credit card required

No credit card required